For those who are interested in German market for micro-living and student housing, we have taken a look into our data to figure out some facts which may improve the understanding of the German student housing market.

Identifying tense student markets

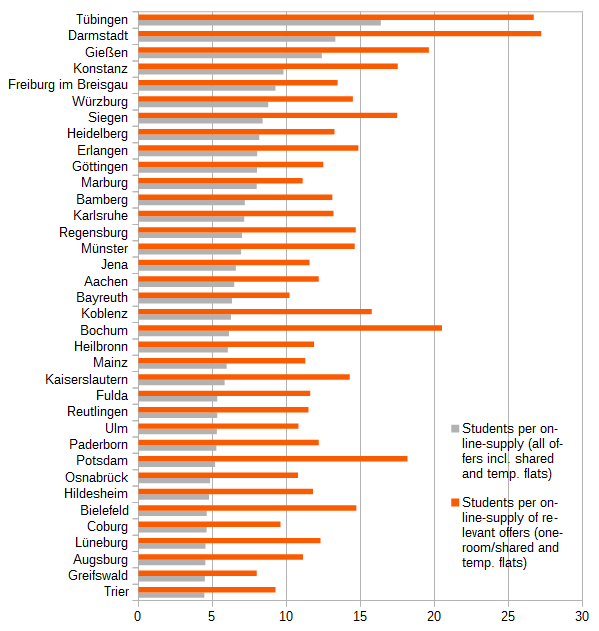

The university cities show the highest student demand excess, measured by students per online ads [(students – students in residence halls)/online offers)] , especially in student compatible sub-markets (‘one-room-flats’, ‘shared flats’ and ‘temporary living offers’). In Tübingen and Darmstadt there are more than 25 students for each student compatible residence offer.

Shared flats are an essential sub-market

We found out, that the market segment ‘shared flats’ is essential and valuable in context of analysing student housing markets as well as for micro-living issues.

High market shares of ‘shared flat offers’ indicate student markets, as well as markets with high demand for ‘one-room-flats’ and ‘micro-apartments’. Rates for ‘shared flats’ also indicate accepted market rents, their upper percentiles show a critical willingness to pay and their spatial distribution indicates student hotspots. Despite these aspects the segment is hardly under investigation.